Have you ever struggled to save money for special events or big purchases? Many people find it hard to keep track of their savings. That’s where sinking funds come in. They are like mini-savings plans for different things you want to buy or save for.

But how can you track your sinking funds effectively? Imagine knowing exactly how much you have saved for a vacation or a new gadget. Wouldn’t that be awesome? You can take charge of your savings with a few simple steps.

In this article, we will explore ways to track sinking funds. You’ll discover tips and tricks that make it easy to manage your savings. Let’s dive in and find out how to make your money work for you!

How To Track Sinking Funds: A Complete Guide To Success

How to Track Sinking Funds

Tracking sinking funds can be simple and effective. Start by setting clear savings goals for items like vacations or new appliances. Use a budgeting app or a simple spreadsheet to monitor your progress. Update your records regularly to stay motivated. Did you know that visual trackers, like charts or jars, can make saving even more fun? By seeing your funds grow, you might feel inspired to save more. This way, you can achieve your goals without financial stress!Understanding Sinking Funds

Definition and purpose of sinking funds. Benefits of using sinking funds for financial planning.Sinking funds are special savings jars for specific goals. They help people prepare for big expenses like a vacation or a new computer. By saving little by little, you can make paying for things easier. Using sinking funds has many benefits:

- They prevent surprises in spending.

- They give you peace of mind.

- They help manage money wisely.

With sinking funds, you stay on track and reach your goals faster!

What are the benefits of sinking funds?

Sinking funds help save for future expenses, avoid debt, and reduce financial stress. They teach you to save money in a fun way and keep you organized!

Setting Up Your Sinking Funds

Steps to establish sinking funds tailored to your financial goals. Recommended categories for sinking funds (e.g., vacations, emergencies).Starting your own sinking funds can feel like a treasure hunt! First, think about your dreams. Do you want to go to Hawaii or build an emergency stash? Make a list of your goals. Next, decide how much money you can set aside each month. Remember, even small amounts add up over time! Consider categories like vacations, car repairs, or pet expenses. Here’s a quick table to help you out:

| Category | Example Goal | Monthly Savings |

|---|---|---|

| Vacation | Beach trip | $50 |

| Emergency | Medical costs | $30 |

| Car Repairs | New tires | $25 |

Enjoy the process! Watch as your savings grow, and soon you’ll be off on adventures!

Choosing the Right Tools for Tracking

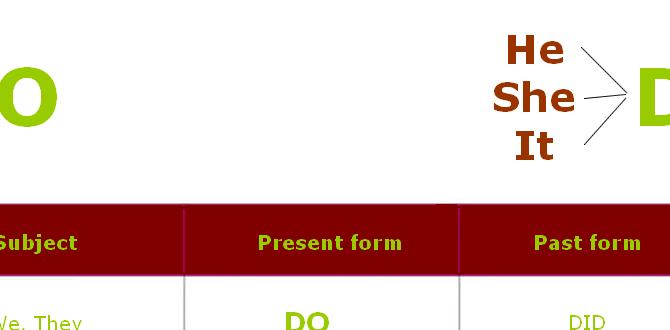

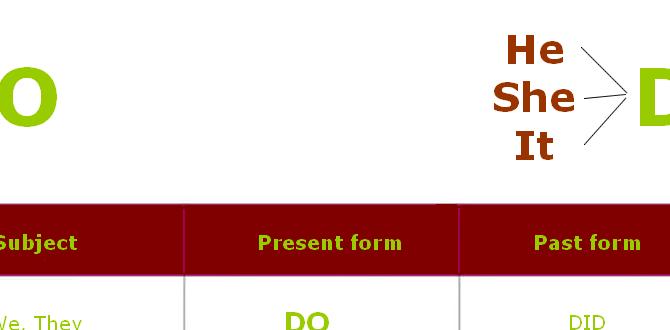

Comparison of digital vs. manual tracking methods. Popular apps and spreadsheets for effective sinking fund management.Tracking your sinking funds can be fun and easy! You can choose between digital and manual ways to keep an eye on your savings. Digital tools like apps and spreadsheets make it quick and neat. They can show your progress in real-time. Manual methods, like notebooks, are simple and personalize your goals. Which do you prefer?

- Digital Tools: Use apps like Mint or Google Sheets to manage your funds.

- Manual Methods: Use a notebook or planner to jot down your goals and amounts.

- Quick Updates: Digital methods allow easy updates on your savings.

Choosing the right tool can make tracking fun and simple. Try both and see what works best for you!

What are the best apps for tracking sinking funds?

Popular apps include Mint, YNAB (You Need a Budget), and GoodBudget. They help you easily manage and track your savings!Why choose a spreadsheet for tracking?

Spreadsheets help visualize progress and allow for customization, making it easy to fit your needs.Creating a Budget for Your Sinking Funds

How to determine the right amount for each sinking fund. Tips for integrating sinking funds into your monthly budget.Budgeting for sinking funds is easy with the right steps. First, think about your goals. Decide how much money you need for each fund. This helps you save better. Each month, add a fixed amount to your budget for these funds. This way, you’re ready for unexpected expenses.

- Start small and adjust as needed.

- Set specific amounts for each fund.

Using these tips, tracking your sinking funds becomes simple and effective!

How much should I save each month for sinking funds?

To determine your monthly savings, add up your target expenses and divide that by the number of months you plan to save. For example, if you need $600 for a vacation in a year, save $50 each month.

How to Contribute to Your Sinking Funds

Methods for consistent contributions to each fund. Strategies for adjusting contributions based on income fluctuations.Building sinking funds can be as fun as bagging the last cookie on a plate! One great method for regular contributions is setting up automatic transfers from your bank account. You can name each fund, like “Vacation Fun” or “Car Repairs,” so they feel exciting. For those months that feel tighter, try adjusting your contributions. If you earn less, don’t panic; cut back a little, but keep some savings flowing. Remember, even a small amount adds up over time!

| Month | Regular Contribution | Adjusted Contribution |

|---|---|---|

| January | $100 | $100 |

| February | $100 | $75 |

| March | $100 | $100 |

Monitoring and Adjusting Your Sinking Funds

Importance of regular reviews and adjustments. Signs that may indicate a need to change your sinking fund strategy.Keeping an eye on your sinking funds is important. Regular reviews help you see how well your plan is working. It can show if you need to make changes. Look for signs like:

- Increased expenses that pop up.

- Goals that need more funds than expected.

- Expenses you no longer need to save for.

Adjusting your funds keeps them effective. Your savings should match your needs!

Why should I review my sinking funds often?

Regular reviews help keep your savings on target.

Case Studies: Successful Sinking Fund Management

Reallife examples of individuals or families using sinking funds effectively. Lessons learned from successful sinking fund strategies.Imagine the Johnson family. They wanted a vacation but had no extra money for it. They started a sinking fund, saving a little each month. By summer, they had enough to go to the beach! Their main lesson? Saving can be fun!

Next, we have Emily. She saved for a new laptop with her sinking fund. After a few months, she finally bought it and felt proud. She learned that small steps lead to big rewards!

| Example | Goal | Lessons Learned |

|---|---|---|

| Johnson Family | Vacation | Saving can be fun! |

| Emily | New Laptop | Small steps lead to big rewards! |

These stories show that sinking funds work! Organizing savings helps achieve dreams. So, why not give it a whirl? You might have some funny stories yourself!

Conclusion

In summary, tracking sinking funds helps you save for future expenses. Start by setting clear goals for each fund. Use a simple spreadsheet or an app to monitor your progress. Review your funds regularly to stay on track. With consistent effort, you can reach your savings goals. For more tips, check out budgeting resources or financial blogs.FAQs

What Are Sinking Funds, And How Do They Differ From Traditional Savings Accounts?Sinking funds are special savings you set aside for specific expenses, like a bike or a school trip. You decide how much money to save each month for that goal. A traditional savings account is for general saving and doesn’t focus on a specific need. With sinking funds, you can track your progress and know exactly when you can buy what you want!

What Strategies Can I Use To Effectively Track My Sinking Funds Over Time?To track your sinking funds, you can create a simple chart or use an app on your phone. Make a list of each fund and how much money you need for each one. Every time you add money, write it down. Check your list regularly to see your progress. This helps you stay on target and reach your savings goals!

How Often Should I Review And Adjust My Sinking Fund Contributions?You should review your sinking fund contributions every few months. This helps you see if you’re saving enough. If your goals change, adjust your contributions. Remember to check your progress regularly. It’s like checking your homework to keep everything on track!

What Tools Or Apps Are Available To Help Me Manage And Monitor My Sinking Funds?You can use apps like YNAB (You Need A Budget), GoodBudget, or Honeydue to manage your sinking funds. They help you set aside money for things you want later, like a new toy or a trip. You can see how much you have saved and plan for your goals. These apps are easy to use and keep everything organized. They even let you track your money in different categories!

How Can I Ensure That I Stay Disciplined In Contributing To My Sinking Funds Regularly?To stay disciplined with your sinking funds, set a specific amount to save each week. You can pick a day, like Friday, to save. Make it a fun habit! You could even use a jar or an app to track your savings. Remember, every bit adds up!